Solar power offers valuable financial benefits including lower monthly bills, protection from rising utility rates, and increased home value. Choosing the right financing option – whether cash purchase or through the Michigan Saves loan program – determines your immediate costs, long-term savings, and overall return on investment.

At Strawberry Solar, we’re committed to transparency, providing clear information about all costs and benefits to help you make the best financial decision for your situation.

Many of our customers will pay for their solar panel installation via Cash, Credit, Check or through a program like Michigan Saves. In some cases we’ve had some leveraged a refinanced mortgage or HELOC to cover the upgrade.

We are an authorized contractor in the Michigan Saves program.

Michigan Saves is a nonprofit green bank that makes clean energy financing accessible to Michigan residents. It operates as a financial program that connects homeowners with authorized lenders.

The program helps Michigan families reduce costs by financing various energy improvements, including renewable energy sources like solar panel installations.

You’ll need our contractor ID to fully apply. If you’ve decided on Michigan Saves or if you have any questions about the program, please reach out and we would be happy to assist!

Call us at (313) 960-7900

Federal & State Incentives

The federal solar Investment Tax Credit remains available for commercial, nonprofit, and public-sector solar projects. Eligible systems can receive a base credit of 30% of total project costs, with the potential to qualify for additional bonus credits depending on project characteristics.

The federal residential solar tax credit has expired and is no longer available for new home solar installations. Residential systems completed before the program’s expiration remain subject to the rules in effect at the time they were placed into service.

For any project claiming a federal tax credit, keep all documentation related to your solar installation, including contracts, invoices, proof of payment, and utility permission-to-operate records. These documents are necessary to support credit eligibility and compliance.

Return on Investment with Solar

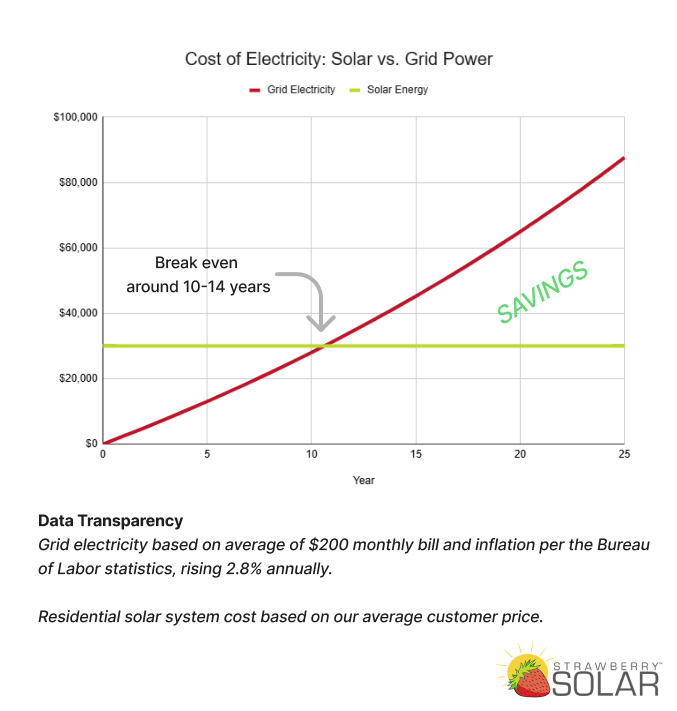

Your solar ROI (Return on Investment) is your total savings on electricity costs once you’ve passed your payback date. Let’s look at how to calculate solar panel ROI.

Many of our customers see a payback or return on investment with their solar panels within 10 – 14 years.